Useful Links

- [RFC] Treasury Diversification & Protocol Owned Liquidity (multichain HOP/ETH LPs)

- [RFC] V2 Open questions (financial perspective)

- [RFC] - Hop Treasury Management Framework

Summary

- This RFC outlines the importance of prioritizing financial stability for HopDAO and introduces the first part of a three-part proposal aimed at effective treasury management.

- The core of the Framework emphasizes the importance of a structured approach to managing the treasury to guarantee resilience and promote sustainable growth. This includes transparent operations, a clear financial plan, and strategies to uphold token stability.

- Prior to the snapshot, active engagement with the community is essential to gather feedback and refine the proposed framework

Intro

After discussing with delegates and reviewing poll results, along with understanding the DAO’s potential from a developer’s perspective, it’s clear that prioritizing Hop Financial Stability is crucial. Managing the treasury involves many aspects, from basic budgeting to dealing with complex issues like protocol-owned liquidity and spreading out investments.

Our plan is straightforward:

First, we’ll identify the main problems and decide what’s most important. We’ll use feedback from the community and look at the DAO’s current financial situation, especially with the upcoming V2 launch. This will help us figure out where to focus our efforts.

Next, we’ll create a simple plan for managing the treasury. We’ll outline basic rules and goals for how to handle our money. This will give us a clear path forward and make sure everyone knows what to do. This is the initial part and it will be covered in this post.

Then, we’ll look at how to manage the liquidity of our token. We’ll talk about why it’s important and come up with ideas to keep our token stable and attractive to investors. This will be the second part of our RFC.

Lastly, we’ll set up a plan for how to actually do all this. We’ll decide who’s in charge, what goals we want to meet, and how we’ll measure our success. This will be like a roadmap for the DAO to follow and it will be the third and the last part of our RFC.

With this plan, we’ll be ready to manage our treasury effectively and make sure Hop stays strong and successful.

Let’s work together to make it happen!

Problem Statement

Improving our financial stability is essential for the DAO’s success, just like it is for any other business. We need to consider all aspects of our finances, but we also need to prioritize what’s most important.

The Hop Protocol makes a lot of money, but not all of it goes into our HopDAO Treasury. We have a great community, and it’s important to listen to them to understand how they see the financial situation and what’s important to them when making investment decisions.

Recently, we did a survey to find out what the community thinks we should focus on. From the feedback we received from delegates, the survey, and my own experience, here are the things that HopDAO needs:

a) Hop requires a systematic and well-thought-out approach to managing its treasury to ensure the DAO’s financial resilience and create a platform for sustainable growth.

b) To achieve this, we need a Treasury Management Framework. This framework should include:

- a transparent operational model with actions, accountable persons, and governance structure,

- a well-defined financial plan that aims to establish a sustainable runway, liquidity targets, supplemented by proactive budgeting, and regular reporting,

- a HOP token liquidity management plan to ensure Protocol’s token stability and attractiveness for current and future investors.

These priorities form the foundation for the Treasury Management Framework that I’m about to introduce.

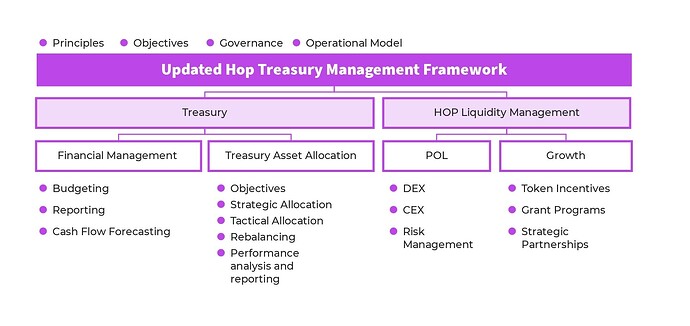

Updated Hop Treasury Management Framework

We have laid out the basic structure needed for a successful treasury management plan here.

Now, let’s refine and tailor it to fit the priorities of our DAO. As mentioned earlier, the key is to focus on setting clear principles and objectives from the start. Once we have this solid foundation, our governance process will become transparent and flexible enough to adjust to changes in the market and our financial needs over time.

TMF Initial Components

The structure of the content within the Treasury Management Framework is designed to provide a comprehensive approach to treasury management for Hop. It encompasses the following key components:

1. Treasury Management Principles

Following these principles helps us manage our DAO’s finances well. We focus on being open, inclusive, and responsible. These principles help us handle our funds in a decentralized way, aiming for transparency, reducing risks, and aligning with our goals.

- Transparency: We believe in open communication and sharing relevant information about the DAO’s finances. Everyone should have access to know how funds are allocated and investments are made. Transparency builds trust and ensures that everyone is on the same page. We commit to monthly financial reporting, accessible via the Hop Community Forum.

- Simplicity: “Simplicity is the ultimate sophistication”. We believe in simplicity over complexity. Treasury management doesn’t have to be convoluted and confusing. We aim to streamline our processes, making them accessible and easy to understand for everyone involved. By keeping it simple, we reduce risks and avoid unnecessary complications.

- Diversification: We encourage spreading the risk by diversifying our investments. Instead of relying on HOP, we explore various opportunities across stablecoins, ETH, and WBTC, deployed across multiple DeFi protocols and strategies. Diversification keeps us balanced and safeguards against unexpected exploits.

- Accountability and Decentralisation: We recognize the importance of having a dedicated individual or team responsible for driving decisions forward. This ensures that inertia is overcome and progress is made. While we value efficiency, we also advocate for a democratic process where the DAO collectively votes on fundamental guidelines. This strikes a balance between swift action and maintaining oversight to prevent reckless trading practices.

- Risk Management: Our foremost priority is safeguarding our financial resources. We meticulously assess various risk metrics, from market-related risks to strategy-specific vulnerabilities, ensuring our treasury remains robust and sustainable.

- Focus: Our treasury management decisions should align with our DAO’s objectives, focusing on ensuring the long-term sustainability of the DAO and it’s token. By keeping our objectives in sight, we make purposeful and impactful decisions.

2. Treasury Management Objectives

As framed in the problem statement section, the goal of the Treasury Management is to build:

“…a systematic and well-thought-out approach […] to ensure the DAO’s financial resilience and create a platform for sustainable growth.”

I.e., translating this into 5 key objectives that inform our work for the framework:

- Meeting Operational Needs: One of the primary objectives of the DAO’s treasury management is to ensure that a DAO has sufficient cash and liquidity to meet its financial obligations and fund its day-to-day operations. This involves optimizing cash flows, managing working capital effectively, and maintaining appropriate levels of liquidity to mitigate the risk of cash shortages. The rest of the longer-term oriented capital, e.g., not needed within the next 24-36 months for operational needs, should be used to take advantage of investment opportunities with different risk profiles.

- Provide a sustainable liquidity for HopDAO token: Liquidity is a foundational element for the success and stability of any token-based project. It ensures that new investors can seamlessly enter the market while providing an exit path for those looking to divest. HopDAO Treasury should be able to identify mid-term liquidity improvement strategies, and propose long-term solutions to enhance protocol liquidity.

- Data-Driven Decision Making: By leveraging data, we aim to optimize investment choices, risk management strategies, and operational efficiency. This principle ensures that our DeFi strategies are grounded in solid analysis of on-chain and off-chain data, as well as utilising state-of-art statistical concepts, enhancing the effectiveness of our treasury management.

- Overseeing Risks, related to Treasury: Treasury management aims to identify, assess, and manage various financial risks faced by a DAO. This includes protocol risk, liquidity risk, credit risk, market risk, and operational risk. The objective is to implement strategies and/or hedging techniques to minimize the impact of these risks on the DAO’s financial performance.

- Regulatory Considerations: We stay updated on DeFi regulations to adapt our strategies and partnerships accordingly. This helps us avoid legal risks and adjust our investments as needed. We stay resilient and flexible amid regulatory changes.

Once the DAO approves these initial components, we can move forward with implementing and executing the framework.

TMF Top Priority Components Overview and Next Steps

Now, we’re at a critical point where we need to discuss the practical execution of our objectives. The proposal will be divided into two main areas: Protocol Liquidity Management and Treasury Management execution. Here’s what you can expect in Part 2 and Part 3:

Part 2 - Protocol Owned Liquidity Management Overview:

- POL Research: Every decision made by the DAO should be rational and data-driven. I aim to provide the Hop community with an overview of common practices used to manage protocol liquidity. The goal is to assess various protocols and strategies, ranking them based on our specific needs.

- Protocol Liquidity Management Framework: In this section, I’ll introduce the principles I plan to use to achieve deep liquidity and price stability.

Part 3 - Treasury Management Mandate:

This final part of the RFC will be structured as a mandate, which will be submitted to the snapshot after gathering all necessary feedback from the community and delegates. Here are the topics we will discuss:

- Treasury Management Operational Model & Governance: This section outlines the central components of the framework, aligning all stakeholders and ensuring clarity in the treasury management process. It details procedures, policies, and tools for efficient cash flow management, risk mitigation, and decision-making within the DAO.

- Financial Management and Budgeting: Emphasizing cash flow forecasting and liquidity management, this section explores strategies to ensure adequate liquidity for operational needs. It aligns budgeting practices with the DAO’s financial goals.

- Treasury Asset Allocation: Efficient allocation of treasury funds is vital for maximizing returns while managing risk. This section covers the selection and allocation process for deploying the DAO’s financial resources, including diversification, rebalancing, and investment strategies.

- Reporting: Transparency is essential for the success of a DAO. This section focuses on reporting tools and mechanisms to ensure full transparency in treasury management, emphasizing timely and accurate reporting for stakeholders.

- KPIs, Deliverables, and Terms: This section outlines the specific terms, expectations, timeline, and compensation associated with the mandate.

Conclusion

By implementing the Treasury Management Framework, HopDAO can establish a robust and sustainable approach to managing its financial resources. This framework guides every aspect of treasury management, from principles to governance, empowering DAOs to make informed decisions and achieve their financial goals while maintaining transparency and mitigating risks.

I’m thrilled to be part of this journey and excited to contribute to HopDAO’s Treasury success. Your feedback on this proposal is invaluable, and I welcome any thoughts or suggestions you may have. Feel free to reach out to me directly through DMs for a more detailed conversation. Let’s work together to shape the future of HopDAO!