Goals and Motivation

In the interest of bolstering the financial health and autonomy of the Hop Protocol, this proposal presents an initiative to further diversify the Hop DAO treasury holdings while establishing the beginnings of significant protocol-owned liquidity (POL). This move aims to mitigate the current skew between HOP’s circulating market cap and its fully diluted value, which stands as an impediment to stable price discovery and large-scale, value-aligned investment in HOP from non-private parties.

HOP’s circulating to fully diluted supply is far too skewed (4M circulating mkt cap, 40M fully diluted value FDV). This skew makes it difficult for proper price discovery to occur and even more difficult for anyone to make a large, opinionated allocation to HOP at a stable valuation in the open market. Moreover, as the HOP token is playing an increasingly growing role in the protocol, POL increases accessibility for the token while generating fees for the DAO. This proposal brings idle HOP into the market, makes it productive, increases market liquidity, and retains DAO ownership.

Generally, the amounts are small and ensure a continued reserve of HOP in the treasury for future developmental use cases such as grants, incentives, and other value-creating opportunities.

Proposal Details

This proposal would seek to:

-

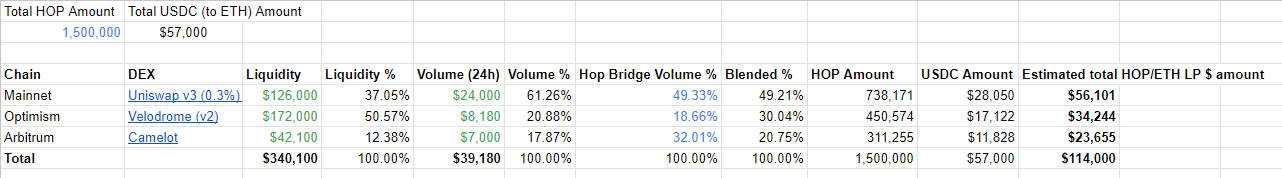

Allocate 1,500,000 HOP ($57,000 @ $.038) and 57,000 USDC from the treasury for distribution to Mainnet, Optimism, and Arbitrum. The total value is ~$114,000 ($57,000 + $57,000).

-

Sell 57,000 USDC for ETH

-

Bridge HOP and ETH to each chain in the predetermined proportions (see calculations further down in proposal):

- Mainnet: 49.33%

- Optimism: 30.04%

- Arbitrum: 20.75%

-

Deposit HOP/ETH liquidity into DEXes

- Mainnet: Uniswap v3 0.3% tier (full range?)

- Optimism: Velodrome v2

- Arbitrum: Camelot v2 (potentially v3?)

-

Lastly, deposit veNFT into compounding Relay strategy created for us by Velodrome (including this in this proposal, because it’s DEX related and fairly low stakes)

Each chain/dex’s proportion of the 1,500,000 HOP is decided as a blended percentage of each DEX’s HOP liquidity & HOP 24 hr volume, and each chain’s percentage of Hop protocol’s bridging volumes (from volume.hop.exchange). Current HOP/ETH liquidity across chains is ~$350,000, so this proposal would increase the outstanding liquidity by ~33%. You can see the breakdown of current liquidity, volume, and bridge volume here in order to calculate the blended percentages:

link to sheet

These 3 chains are lower hanging fruit because we already have multisig capabilities and they’re the top 3 by liquidity and bridging profiles by quite a large margin. In the future we can and should look into Base, Polygon, Gnosis and other chains that Hop Protocol supports.

Notably, this proposal requires zero expenditures or ongoing incentives from the DAO. It simply pairs idle HOP in the treasury with a small amount of idle USDC (to sell for ETH).