[RFC] - Hop Treasury Management Framework

Author Comment

web3 Studios (“w3s”) is a digital assets investment banking firm exclusively focused on companies building an open economy. Founded by Blackstone and McKinsey alumni, the group facilitates M&A, capital raising, and strategic projects for DAOs.

The group is leading an ecosystem initiative for Uniswap, doing Strategic and Treasury Management Work for Gro DAO, has previously been engaged with Zerion, and conducted research work together with leading web3 firms such as Polygon, The Sandbox, and DappRadar.

Summary

- This RFC seeks to establish a benchmark for Treasury Diversification by introducing the Treasury Management Framework (TMF) and offering an OTC token sale to strategic partners.

- The TMF represents a robust, adaptable framework designed to ensure the financial stability of the DAO while preserving its decentralized governance principles.

- After implementing the framework, our proposal includes conducting an OTC token sale to strategic partners. This initiative aims to bolster Hop DAO’s expansion and extend Hop’s financial runway.

Rationale

A few weeks ago, @cwhinfrey posted a Treasury Diversification RFC, proposing to sell part of the $ARB received for USDC to help cover the ongoing DAO expenses.

After contributing to the original discussion post, we drafted an initial idea, which has been thoughtfully adjusted thanks to the invaluable feedback received thus far from the community.

In light of considering research on Treasury Diversification, we are exploring various avenues for the sale of HOP, including the possibility of an OTC Partnership deal, to provide a planned and strategic approach to stabilizing and improving the DAO’s financial viability.

Current State of HOP Treasury

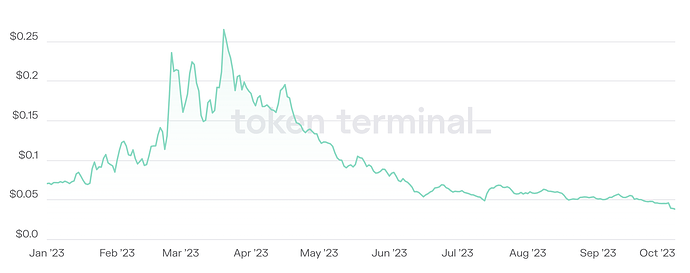

HOP’s treasury currently holds a substantial $24.2 million, but it is exclusively exposed to HOP tokens, constituting a 100% allocation. This concentration has posed challenges, particularly as the HOP token’s price has experienced declines.

YTD Treasury Value ($). Source: DeFiLama

Hop DAO faces challenges accentuated by the fact that their monthly expenses are primarily denominated in HOP. This specific denomination makes it difficult for Hop DAO to maintain a precise grip on operational costs. To address this, there’s a pressing need for Hop DAO to establish a diversified treasury, which includes stablecoins. Such a strategic move in diversification is not just a financial necessity but also a strategic imperative. It ensures the smooth functioning of daily operations and provides the Hop DAO team with the bandwidth to focus on broader strategic growth initiatives.

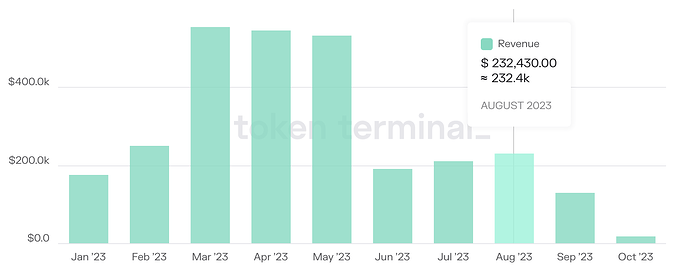

Hop DAO’s revenue model is intricately tied to the protocol fees, which serve as the primary source of protocol revenue. These fees, in turn, are significantly influenced by the number of active users. It’s a model that leans heavily on user engagement and adoption. To put things into perspective, since the onset of this year, the protocol has been successful in generating a commendable $2.9 million solely in fees.

However, a deeper dive into Hop DAO’s financials reveals a concerning trend. Operational expenses, unfortunately, have overshadowed the revenue. Hop DAO is currently operating at a burn rate of $169.3k per month. This financial trajectory underscores the urgency and the absolute necessity for Hop DAO to revisit and optimize the treasury strategy. It’s not just about sustainability anymore; it’s about positioning for future growth.

Monthly YTD Protocol revenue. Source: TokenTerminal

Addressing these challenges, there are several avenues to improve the treasury allocation, one of which will be elucidated in the upcoming chapter.

Treasury Stats

Monthly Net Burn Rate

The average monthly net burn rate is $169.35k.

| Expenses | Revenue | Treasury (YTD Change) | |

|---|---|---|---|

| Monthly average (2023) | $484.6k | $315.3k | −46.9% |

Hop Protocol YTD data

| Token Incentives | Operational Expenses | Total Expenses | Revenue | Profit | |

|---|---|---|---|---|---|

| January | -$177.3k | -$207.7k | -$385k | $177.3k | -$207.7k |

| February | -$252.9k | -$272.3k | -$525.2k | $252.9k | -$272.3k |

| March | -$467.8k | -$501.6k | -$969.4k | $556.3k | -$413.1k |

| April | -$315.7k | -$465.6k | -$781.3k | $547.8k | -$233.5k |

| May | -$191.4k | -$290.4k | -$481.8k | $534.2k | $52.4k |

| June | -$179.4k | -$218.3k | -$397.7k | $191.9k | -$205.8k |

| July | -$108.1k | -$166.7k | -$274.8k | $213.1k | -$61.7k |

| August | -$97.4k | -$179.4k | -$276.8k | $232.4k | -$44.4k |

| September | -$105.8k | -$160.9k | -$266.7k | $131.5k | -$135.2k |

| October (ongoing) | -$10.1k | -$144.8k | -$154.9k | $15.8k | -$139.1k |

| YTD | -$1.9m | -$2.6m | -$4.5m | -$2.9m | -$1.7m |

HOP Token

| HOP ATH | HOP ATL | As of 05.10.23 | |

|---|---|---|---|

| Price | $0.2972 | $0.0366 | ~$0.0371 |

– Source: TokenTerminal, etherscan

YTD HOP token price. Source: TokenTerminal

Treasury Management Framework (TMF)

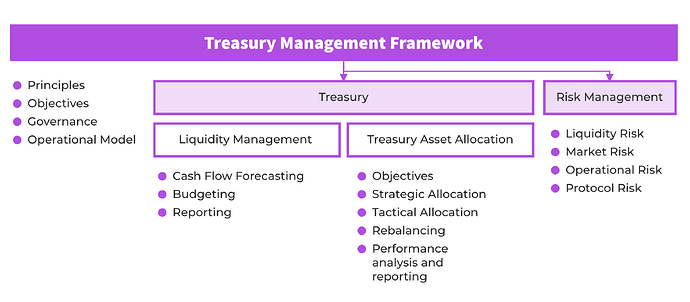

To effectively tackle the issues at hand, we propose the establishment of a Treasury Management Framework (TMF). This encompassing framework is meticulously designed to cater to the unique needs of Hop DAO and address various facets of treasury management. The primary objective of this framework is to furnish the DAO with lucid and well-defined treasury guidelines, all while maintaining the decentralized essence of the DAO governance process.

It’s worth emphasizing that the primary focus lies in the initial stages, where it is crucial to establish clear principles and objectives. However, once this foundation is in place, the governance process becomes transparent and readily adaptable to evolving market conditions and financial needs.

Treasury Management Framework

Let’s delve into the key components that form the bedrock of this framework:

- Treasury Management Principles: The foundation is laid with a clear articulation of fundamental principles that underpin effective treasury management. These principles serve as guiding pillars, aligning the decision-making process with the overarching objectives of the DAO, all while taking into account the risk appetite.

- Treasury Management Operational Model: This central component defines the nitty-gritty of the treasury management process, creating alignment among all stakeholders and ensuring clarity in the entire treasury management workflow. It outlines the procedures, policies, and tools employed to enable efficient cash flow management, robust risk mitigation, and well-informed decision-making within the DAO.

- Liquidity Management and Budgeting: The spotlight here is on the critical aspects of cash flow forecasting and liquidity management within the context of DAO treasury management. We need to explore strategies aimed at ensuring an adequate liquidity buffer to meet operational needs while harmonizing budgeting practices with the DAO’s financial objectives.

- Treasury Asset Allocation: The efficient allocation of treasury funds takes center stage here. This involves the selection and allocation process for deploying the DAO’s financial resources, encompassing diversification, periodic rebalancing, and investment strategies. The aim is to secure Hop’s financial stability while carefully considering risk management objectives.

- Risk Management: Risk management is a paramount consideration at every juncture of the Treasury Management Framework. This section underscores the significance of identifying, assessing, and mitigating various risks associated with treasury operations, investment decisions, and market volatility. It offers clear guidelines for implementing robust risk management practices within the DAO.

- Governance: As governance lies at the heart of decentralized operations, we will delve into how the Treasury Management function operates in a decentralized fashion of Hop DAO. It underscores the need for transparent decision-making processes, active community involvement, and rigorous accountability in managing the DAO’s financial resources.

- Reporting Tools: Transparency is the linchpin of any DAO’s success, and this section hones in on the reporting tools and mechanisms employed to ensure complete transparency in treasury management. It underscores the significance of timely and accurate reporting, providing all stakeholders with crystal-clear visibility into the DAO’s financial activities.

By implementing the Treasury Management Framework, HOP DAO has the opportunity to establish a robust, sustainable, and adaptive approach to managing its financial resources. This framework acts as a trusted compass, guiding every aspect of treasury management, from fundamental principles to governance practices. Ultimately, it empowers DAOs to make informed decisions, achieve their financial goals, and maintain unwavering transparency while effectively mitigating risks. The result is a well-oiled financial engine that supports the DAO’s long-term vision and objectives.

Treasury Diversification through Strategic Partnerships

To achieve a diversified treasury, the first proposed step is to convert HOP tokens into different assets. Given the current market conditions and our priority of maintaining operational stability, it makes logical sense to convert a portion of the HOP treasury into stablecoins.

Rather than conducting open-market sales that could disrupt market prices, we suggest pursuing OTC sales with strategic partners. This approach ensures a more controlled asset disposition. There are multiple great cases of successful partnerships like Lido and Paradigm, PoolTogether with a pool of investors (ParaFy, Galaxy Digital, Dragonfly Capital 7, and Nancent), and a recent TrueFi X partnership.

Hop stands as a top-5 bridge on Arbitrum and Optimism, boasting a monthly transaction volume exceeding $50 million. It enjoys a strong product-market fit and has a robust community. This sale not only enables the protocol to concentrate on development but also provides an opportunity for strategic partners with extensive networks and expertise to contribute to the project’s growth and business development.

We propose selling an amount ranging from $1-5 million worth of HOP tokens to strategic partners. The final deal size will depend on the agreement between the DAO and a future partner, as well as on the risk preferences DAO set up to ensure a sustainable runway.

Web3 Studios will help conduct benchmarking studies and internal Due Diligence to determine an appropriate valuation and lockup/vesting schedule. We will then compile a comprehensive pitch deck containing all protocol information for potential buyers. Utilizing our network of investors, we will pitch HOP to identify the right candidate. If a suitable buyer is found, we will summarize the deal and create a governance proposal for the community to decide on the sale.

Web3 Studios is actively engaged in over $200 million worth of secondary offers in leading web3 projects, aiming to unlock liquidity for founders and investors. We utilize our broad institutional network to stay informed about investor activity and token launches. Some of the notable projects we’re involved in include Scroll, Sui, LayerZero, and zkSync, among others.

Next Steps

As we kick off this RFC, it marks the inception of a broader conversation within the community. In the event that this initial RFC receives significant feedback, our plan is to proceed with a more detailed proposal, laying out specific deliverables, budget, and timelines. Your valuable insights and thoughts are essential to us, and we eagerly anticipate your contributions to the ongoing success of HOP.

Together, we chart the path forward!

Voting Options

- Move the discussion forward

- No action

- Abstain

- Move the discussion forward

- No action

- Abstain