Abstract:

In an effort to better inform the crypto ecosystem on ongoing fundamental changes and major developments on Hop, we are proposing that Messari initiates coverage and provides quarterly financial reporting. This would serve to attract more builders, entrepreneurs, and investors who would then provide value to the overall network once they are more aware of these core project fundamentals.

All reports would live as free resources on Messari and would be distributed through our newsletter (230k subscribers) and various social channels.

About Messari

Messari is a team of crypto natives passionate about building powerful data analytics tools for the web3 world. The company was started in early 2018 and has since scaled to over 100 employees after raising a Series A led by Point 72 Ventures. We recently received a $12.5 million grant from The Graph to become a core developer to build and standardize subgraphs creating a robust open-source data infrastructure for the broader crypto ecosystem.

Messari’s core products include Messari Enterprise, a leading market intelligence platform for crypto professionals as well as Messari Protocol Services, an outsourced research and investor relations service for many of the top DAOs. This has included long-form research, comprehensive data dashboards, and quarterly reporting for over 150 projects.

Rationale

Currently, there is a high barrier for those within existing project communities and the broader crypto world to stay informed and up to date with all of the major key performance indicators and protocol-level changes. While there are various analytics dashboards, blog posts, and messaging channels, it is still cumbersome to have a strong understanding of all the important developments going on. This leads to a misallocation of resources, both time and money since stakeholders are not acting with the full breadth of knowledge at their disposal.

To alleviate this problem, many top projects and DAOs are expending additional resources to better surface a lot of this core information. These initiatives are serving to increasingly professionalize this industry, however, what is still missing is the proper contextualization of this data from an independent third party that would allow an outsider to gain better insight into what’s going on.

As we continue deeper into a bear market this becomes even more important as stakeholders tend to overweight price as their barometer of project success. By outsourcing this critical investor relations function to a specialist firm, Hop can be better positioned to withstand turbulent times and not fall to the wayside as we’ve seen during the last bear market with projects unable to retain the mindshare of major crypto participants.

Proposal Breakdown

- Initiation of coverage report that breaks down what the project is building and why it matters, while contextualizing it within the broader crypto landscape. It will also delve into a competitive analysis and breakdown of the token economics.

Examples: Osmosis

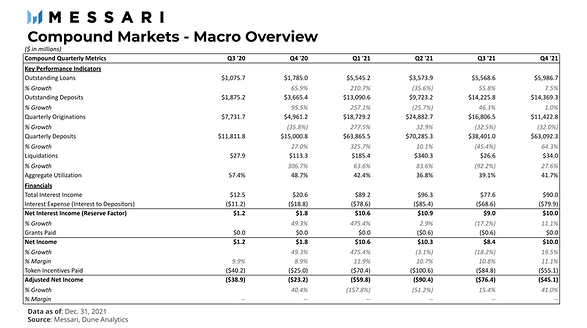

- Four quarterly reports beginning in Q3 that present and analyze key KPIs and fundamental metrics (exchange volume, liquidity, protocol revenue, etc.) from both a macro protocol level as well as more granular specific markets. The report will delve into major governance developments, upgrades, and key roadmap initiatives on a recurring basis.

Examples: Compound

Total cost: $100k total (5 reports)

We understand this is a significant cost for a DAO, particularly in these market conditions, however, this equates to ~$8k/month for the year which is much less than what would be paid to a full-time contributor taking on these crucial responsibilities. (Not to mention the added value from the distribution Messari provides)

We look forward to hearing the communities thoughts as we’re eager to become a long-term partner with Hop protocol!