New bridge tokens can be proposed and adopted now that Hop governance is live. We believe that new bridge tokens should be carefully considered and wanted to share the framework we’ve used to analyze the cost and benefit of new assets for Hop.

Bridge Costs

With the current version of Hop, a stand-alone bridge is deployed for each asset. The main costs associated with each bridge are:

- The overhead related to deploying, maintaining, and providing support for the bridge infrastructure.

- The cost (if any) of maintaining liquidity in the AMMs and Bonder.

Core Tokens and Partner Tokens

The framework classifies tokens into two buckets: core tokens and partner tokens.

Core Tokens

Core tokens are high volume tokens for which there is naturally-strong bridging demand. Winning these markets is essential to Hop’s (proposed) mission. The bridges for these tokens should be self-sustaining either now or in the future without any subsidies. However, in the short-term, subsidizing liquidity for these bridges will help Hop’s competitive edge.

Partner Tokens

Partner tokens are tokens where an external partner is interested in Hop supporting the token and is willing to either provide liquidity or incentivize liquidity for the bridge AMMs and Bonder.

Partner tokens are very likely a win-win scenario if there is sufficient demand for bridging the token. Hop attracts more volume and the partner gets their token supported for bridging. Oftentimes, the partner has plenty of their token on hand and can provide the token for bridge liquidity at little or no cost to themselves. When that’s not the case, the partner can set up incentives for external liquidity to be provided for the AMM and Bonder.

If a partner token bridge begins to show potential for long-term sustainability in the absence of subsidies, the Hop community can begin to consider it as a core asset that should remain even after the partner’s liquidity and/or subsidies are gone.

Hop’s Current Assets

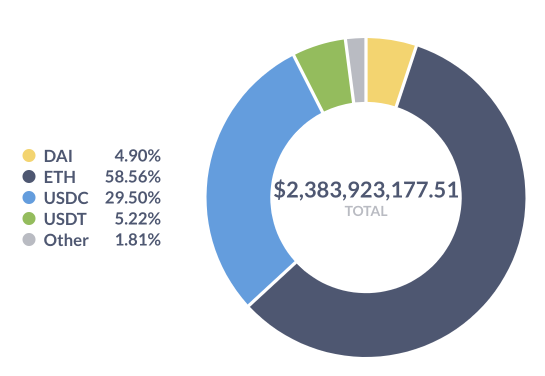

The cumulative volume of Hop’s bridge assets

ETH - We consider ETH a core asset. It’s by far the highest volume asset Hop supports. To date, it’s responsible for well over 50% of Hop’s cumulative volume. We consider it the most important bridge token for obvious reasons and believe the Hop community should prioritize competitiveness in the ETH bridge market over all others.

USDC - We consider USDC a core asset. It has risen to become the dominant stablecoin within the Ethereum ecosystem. It makes up a large portion of Hop’s volume, sitting very comfortably in the number 2 spot. For these reasons, we consider it nearly as important as ETH to Hop’s long-term success.

USDT - We consider USDT a core asset. USDT is one of the earliest stablecoins and one of the largest. It’s also infamously opaque and has carried a mixed reputation since the early days of crypto. We think USDT is relatively less important within the Ethereum ecosystem but is very important in the broader multi-chain universe. Given USDT’s size and reach, we think it makes sense for Hop to keep the USDT bridge competitive and assess its importance after supporting more chains where USDT is highly used.

DAI - We consider DAI a core asset. DAI is the only decentralized stablecoin Hop currently supports. Although it has a marketcap an order of magnitude less than USDC and USDT, it still sits neck and neck with USDT in terms of volume on Hop. We see DAI playing an important role in the Ethereum ecosystem for a long time to come and think Hop should keep the DAI bridge competitive. There also may be opportunities to partner with Maker DAO to increase the DAI bridge’s liquidity and reduce its fees.

MATIC - We consider MATIC a partner asset. The Polygon team has graciously provided MATIC for the bonder as well as MATIC incentives for the AMM. MATIC is also important for Hop’s user experience as any user bridging to Polygon for the first time needs to bridge MATIC first to pay for transaction fees.

Upcoming Tokens

These are assets that we plan to propose to the community for Hop to support next.

HOP (Core Token) - HOP itself can be supported as a bridge token. Because supporting HOP as a bridge token is a bit more nuanced, we’ll give our thoughts in a separate post.

FRAX (Partner Token) - The Frax DAO has approved a $50m AMO to provide both AMM and bonder liquidity for a FRAX Hop bridge. This bridge has the potential to have extremely low fees and slippage, especially for large transfers, which will help position FRAX as a key bridging asset. The sheer size of this bridge shows how much faith the Frax community has in Hop and could be the first step in an important long-term relationship.

sUSD and SNX (Partner Token) - The Synthetix team has expressed interest in both a sUSD and a SNX Hop bridge and have indicated that sUSD and SNX liquidity can be provided directly by Synthetix. These bridges would only support Optimism and Ethereum at first so relatively minimal liquidity is needed. Synthetix is behind some of the most popular projects on Optimism, including Lyra, Kwenta, and Thales. We believe supporting sUSD and SNX is a strong strategic move within the Optimism ecosystem with very little downside.

We’re hoping to see many more tokens proposed by the community in the coming months. ![]()