Hi everyone,

Summary

Copra Finance wishes to partner with Hop Protocol in issuing a protocol loan. The loan would not be used for token liquidity, but to finance protocol activities, offering an additional source of revenue, as proof of the reliability of Hop’s smart contracts, and to prove that Hop can consistently generate revenue to repay the loan interest.

Introduction

Copra Finance helps defi protocols set up loans to help finance their growth and remain competitive. Our high-level goal is to create a secondary market for ‘internet corporate bonds’, comprised of defi protocol loans. We aim to help defi protocols shore up liquidity without distributing native token incentives, although we can help facilitate OTC-style token deals after loans reach maturity. To reiterate, our liquidity deals are not to support your native token, but rather to offer lenders a safe way to finance your growth, with the option to buy some of your native tokens at maturity should they want to.

For our lenders, who are typically tradfi institutions or whales, our bonds are a fixed-income product with ETH, BTC, or stablecoins. Many defi protocols rely on spoken word deals with whales, whose reliability cannot be assured. Copra loans can provide a safer, fairer and more flexible arrangement for both parties.

We are currently developing an Arbitrum Opportunity Vault, a collection of small/medium-sized protocols that wish to finance their growth, we aim to support them by providing them with reliable liquidity. We have also applied for an Arbitrum grant, and if successful will be able to support our borrowers with additional offerings from the grant.

All aspects of our loans are facilitated on-chain through our smart contracts, including a credit account that manages funds, a revenue escrow account that receives future income, and a token warrant account for managing native token deals. Funds can only be deployed from our smart contract credit account to whitelisted pools.

How a Copra Loan Could Benefit Hop

- For borrowers such as Hop, a loan would help to boost TVL and overcome any liquidity bottlenecks. In the case of Hop, loan liquidity would be used to support your bridge pools.

- Seeing as Hop already has considerable TVL, additional benefits of interest include the ability to generate additional income. Any yield generated by the loan funds above the preset revenue escrow ceiling will be returned to Hop at maturity.

- Facilitating deals with whales or other large lenders such as protocols, to provide Hop with rearrangeable, fixed-duration liquidity. In turn, these lenders get a share of protocol revenue to satisfy the loan interest and are paid in the same currency as the loan principal.

- Seeing one of our bonds through to maturity can help give confidence to future liquidity providers. We intend to generate the equivalent of a credit score to be used as proof of your reliability. Being able to repay the loan with interest will also prove Hop’s ability to consistently generate revenue. This may also allow you to assess the validity of your v2 fee structure in supporting Dao activities.

- Finally, you will have the opportunity to sell some of your Hop tokens to lenders at maturity at a predetermined price, this can support your protocol token’s current valuation, and the lenders, having been repaid the loan principal with interest interest will not be under pressure to sell.

From looking at your liquidity pools it is clear that the majority of Hop’s liquidity is in the form of USDC and ETH (over $2m and $8m respectively), hence these would likely be the currency of choice for such a loan, and hence the currency of the loan interest.

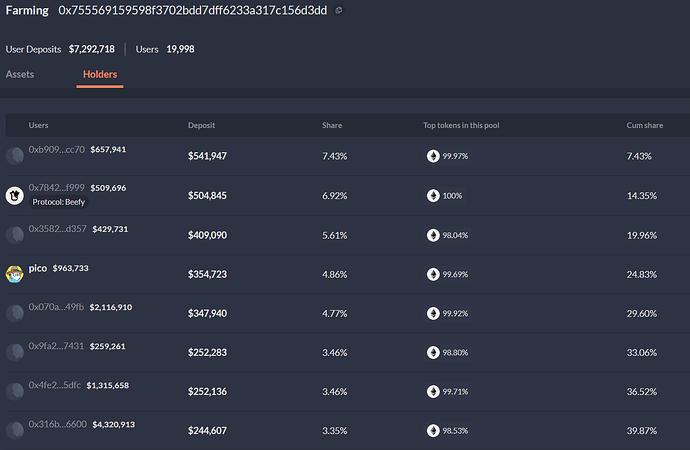

Your ETH pool for example contains many whales and also protocols. Copra’s smart contracts could help to facilitate fixed duration and predictable liquidity deals with any of these lenders. The lenders would receive fixed income from your protocol revenue, and you would receive their liquidity at a fixed interest rate that could be repurposed or rearranged as most beneficial for the protocol. Deals could be made with protocols such as Beefy to enhance their pool yield offerings in exchange for predictable liquidity.

Loan Terms

The ‘risk-free’ yield of defi comes from staked ETH, naturally, the yield on defi protocol bonds must come with a higher yield due to the risk premium. We currently offer 14% APR to our lenders but are open to negotiation.

However, we are open to discussing loan size and duration, as well as servicing any other liquidity needs.

Bottom Line

The bottom line is that Copra’s trustless loans can be used to support Hop in whatever ways are needed. The deployed liquidity is rearrangeable and reliable due to its fixed duration. The entire process is automated by smart contracts, the funds will be under the custody of our credit account.

We are currently developing our product and forming bonds with our first few clients. We have detailed protocol docs, which can be shared on request. Any questions and feedback are welcomed, and we hope to be able to form a long-lasting partnership with Hop.