I am adding some more info to the discussion!

HOP Tokenomics Strategy Selection

Previous Discussions [1] [2], [3]

Simple Summary:

This discussion aims to select a strategy for the HOP token that aligns with long-term value and ongoing protocol development. The results will be the basis for an upcoming strategy to choose a base Layer/Chain for the HOP token, prioritising implementation.

Motivation:

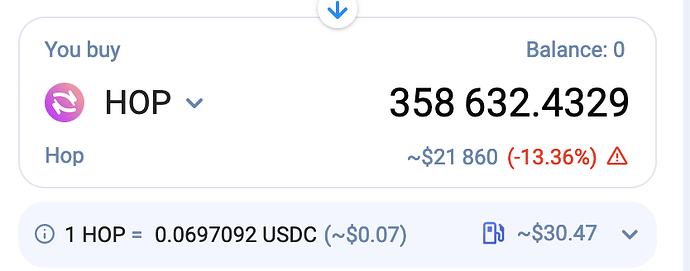

Currently, the HOP tokens suffer from fragmentation and lack liquidity across multiple chains and DEXes such as Uniswap, Quickswap, and Velodrome. Even advanced aggregators like 1inch struggle to execute trades without causing price impact. A clear token economics strategy is needed from the DAO to address this liquidity fragmentation.

Specification:

This proposal aims to answer the following questions:

- Which Chain/Layer should the HOP token prioritise?

-

Arbitrum

-

Optimism

-

Polygon

-

Ethereum

-

Any other chain

- Which DEX should be chosen?

-

Uniswap V3 (available on all chains)

-

Quickswap (available on selected chains)

-

Balancer

-

Other new and decentralised exchanges (Dexes)

- What strategies should be considered?

-

Liquidity boosting through incentives

-

Protocol-owned liquidity strategies

-

Other innovative approaches

Considerations:

To address these questions, please consider the following points:

Chain/Layer Selection:

-

Evaluate the security and priorities of each chain.

-

Consider the specific focuses of different chains, such as Arbitrum’s focus on gaming and DeFi or other chains offering an all-in-one approach.

-

Take into account whether a chain is a side chain or has a more centralised sequencer.

Distribution of HOP:

- Analyze the current distribution of HOP tokens and the associated cost of bridging them to a different chain.

DEX Selection:

-

Examine the current liquidity distribution of HOP tokens, using the resource CoinGecko as a reference.

-

Note that Velodrome currently boasts the highest volume, followed by Uni V3 on Ethereum and Arbitrum One.

-

Evaluate the technical limitations and advantages of different DEXes.

-

Consider whether certain DEXes concentrate liquidity from supporters or enable single-sided liquidity.

Liquidity Boosting Strategies:

-

Consider the advantages and disadvantages of token farming strategies, considering their specific benefits and drawbacks.

-

Evaluate the potential risks associated with single-sided liquidity.

-

Consider the impact on attracting liquidity providers and incentivising long-term token holders.